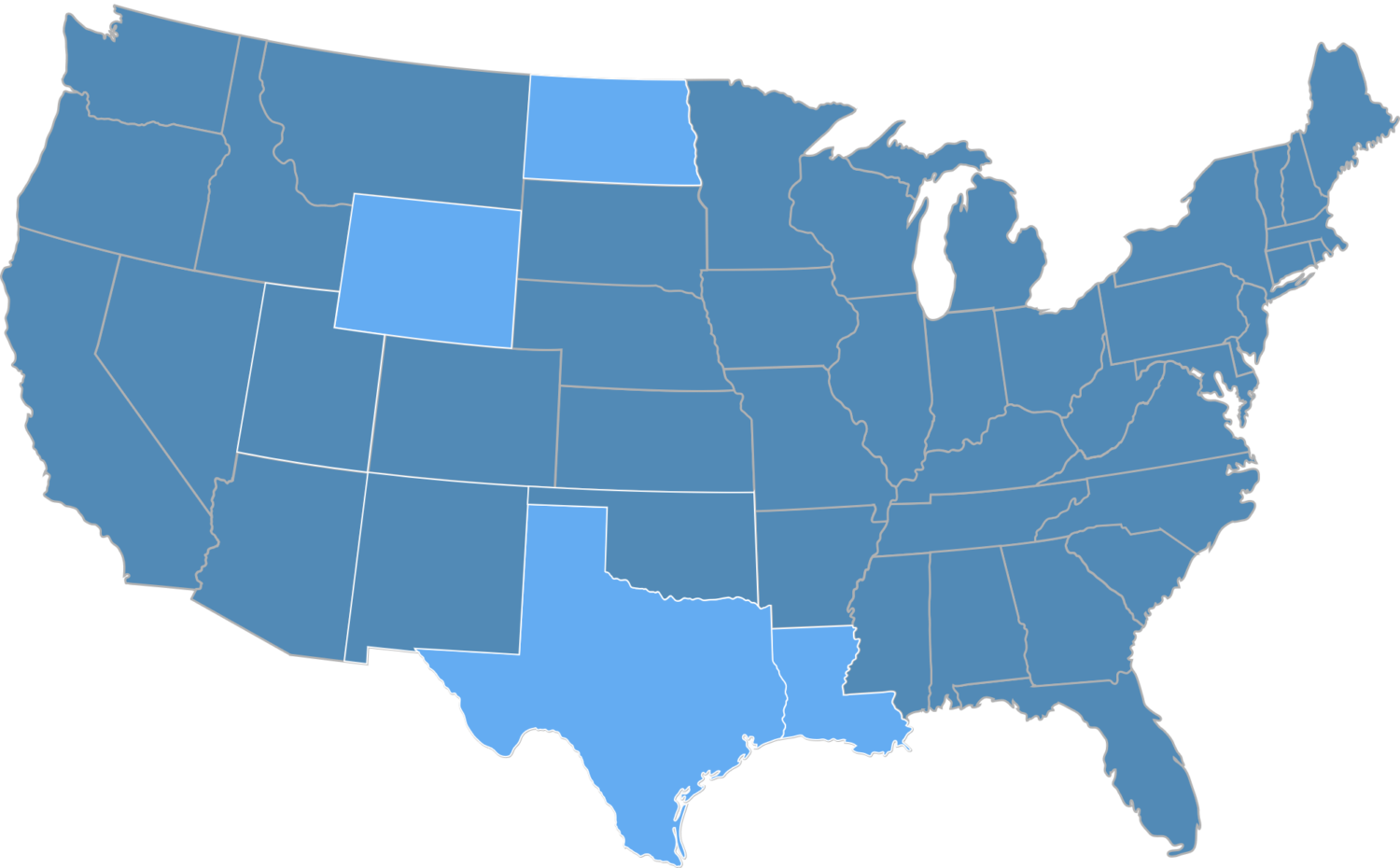

Evolution’s strategy is to invest in producing assets with long-lived, low decline reserves that support our total shareholder return program. We believe our current assets in Louisiana, North Dakota, Wyoming, and Texas will provide returns to shareholders for decades to come. We continuously look for targeted opportunities to grow our asset base accretively.

Our growth strategy is focused on oil and natural gas acquisitions that provide:

- Long-lived assets with value dominated by cash flow positive proved developed producing reserves

- Accretion to free cash flow per share that supports the dividend strategy

- Ability to support production through modest maintenance capital expenditures and lower risk development

- Locations with reasonable market access and stable regulatory environment

- High margin with efficient operations that are economic at existing commodity prices

- Comes with unvalued or undervalued drilling upside